The 2024-25 open enrollment period has now ended. If you need to make corrections to your enrollments effective October 1, 2024, please complete the Insurance Enrollment Change Form.

-------------------------------------

This page reflects information pertaining to the 2024-25 open enrollment period, which begins August 15, 2024 and continues through September 15, 2024. Please refer to the specific employee group benefit pages for detailed information on the 2023-24 benefit programs offered to LCC employees.

This open enrollment period does not apply to Section 125 Flexible Spending Accounts. That open enrollment period, for calendar year 2025, will occur later in the Fall.

2024-25 Insurance Open Enrollment

Participation in Open Enrollment is Optional. To make changes to your enrollment selections and/or dependents covered, please make your elections by September 15, 2024 at MyOEBB. Changes made during open enrollment are effective October 1, 2024 unless otherwise specified.

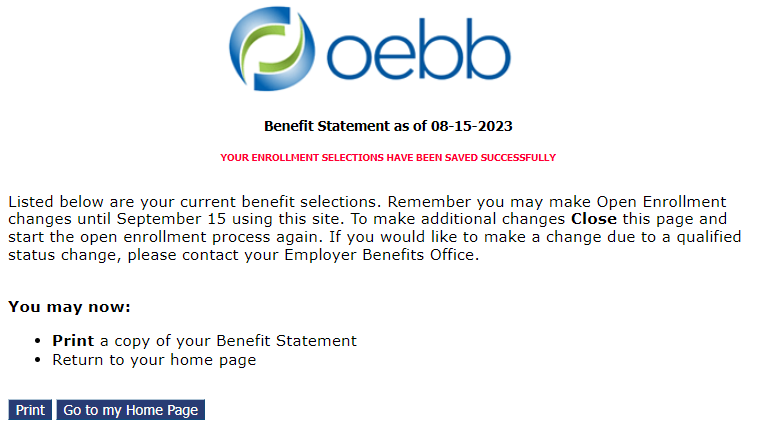

In addition to a pop-up window with fireworks (if your pop-up blocker is turned off), you will know you have fully finished the process when you see the following benefit statement and confirmation that your selections have been successfully saved:

General Information and Links

The information provided by each of the carriers may include details on plans not offered to Lane Community College employees and options vary by employee classification. Please refer to the employee group sections below for the specific plans available.

OEBB Resources

- Online Enrollment Portal

- Enrollment Guide

- Explore Your Benefits - An interactive tool to learn more about your benefits.

- Online Plan Comparison Tool - Customize to see only the plans and benefits that are important to you.

Moda Health Information

- Presentations, Plan Documents, Provider Search Tool, Enhanced Benefits and More

- Open Enrollment Meetings

- Wednesday, August 13th, 11:00 am in person

- Monday, August 18th, 10:00 am virtual (Microsoft Teams Meeting ID: 254 083 198 640 9, Passcode: 7Kc9BD2z)

- Thursday, August 21st, 4:00 pm in person

- Wednesday, August 27, 1:30 pm virtual (Microsoft Teams Meeting ID: 244 059 548 091 2, Passcode: U69PU6uh)

- Tuesday, September 9, 9:00 am in person

- Thursday, September 11th, 3:00 virtual (Microsoft Teams Meeting ID: 229 216 148 113 4, Passcode: Rb9go3Uj)

- What's changing for 2024-25?

- New Services

- Doula Services: Eight prenatal and/or postnatal visits, plus delivery.

- Teladoc: Virtual primary care visits.

- Mighty: Alternative weight management program.

- Gabbi: Breast cancer risk assessment tool.

- New Services

Kaiser Permanente Information

- Enrollment Videos, Plan Documents, Provider Locations, Enhanced Benefits and More

- Schedule an Appointment with a Kaiser Enrollment Specialist

- What's changing for 2024-25?

- New Services

- Doula Services: Eight prenatal and/or postnatal visits, plus delivery.

- Omada: Alternative weight management program.

- Changes

- Prescription drug costs are increasing:

- Generic - $10 at retail pharmacies and $20 through the mail order program.

- Preferred Brand - $30 at retail pharmacies and $60 through the mail order program.

- Non-Preferred Brand - $50 at retail pharmacies and $100 through the mail order program.

- Specialty - $150 maximum amount for each prescription. (coinsurance remains at 25%)

- Prescription drug out-of-pocket maximum will be removed. Amounts paid for prescriptions will apply to the medical plan’s out-of-pocket maximum.

- Prescription drug costs are increasing:

- New Services

Willamette Dental Information

VSP Information

Medical, Dental and Vision Benefits

The insurance plan year is October 1 - September 30. With the start of the new insurance year, accumulators (such as deductible, out-of-pocket maximum, alternative care benefits, etc.) start over, or reset to zero, on October 1.

Moda Exception: Any portion of the deductible met in the last 3 months of the plan year (July 1 - September 30) will carry forward to the new plan year.

Classified employees who have other group medical insurance and choose to opt-out of the College's medical, dental, and vision benefits, are eligible to receive a monthly stipend of $200.00 ($100.00 per paycheck). Coverage from the Individual Marketplace, Oregon Health Plan/Medicaid or Student Health Insurance does not qualify for opt-out benefits.

- Rate Charts

- Plan Comparison (for active classified employees)

- Medical Plans

- Choose from the following:

Kaiser Plan 1

Moda Plan 1

Moda Plan 2

Moda Plan 6* (*Enrollment in a Health Savings Account ("HSA") is optional and available with Plan 6.)

- Choose from the following:

- Dental Plans

- Choose from the following:

Delta Dental Premier (Moda) Plan 1

Delta Dental Premier (Moda) Premier Plan 6

Willamette Dental

- Choose from the following:

- Vision Plans

- Choose from the following:

Moda Opal

VSP Choice Plus

- Choose from the following:

- Medical Plans

- Plan Comparison (for retired classified employees)

- Medical Plans

- Choose from the following:

Kaiser Plan 1

Moda Plan 1

Moda Plan 2

Moda Plan 6

Moda Plan 7

- Choose from the following:

- Dental Plans

- Choose from the following:

Delta Dental Premier (Moda) Plan 1

Delta Dental Premier (Moda) Plan 6

Willamette Dental

- Choose from the following:

- Vision Plans

- Choose from the following:

Moda Opal

VSP Choice Plus

- Choose from the following:

- Medical Plans

Voluntary Life Insurance

(applies to active classified employees only)

The College paid benefit includes $100,000 of basic life insurance coverage for the employee.

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary life coverage.

- Voluntary Life Insurance Rates (see "optional" rate information)

- Voluntary Life Insurance Premium Calculator

A reduction in coverage, an increase in coverage not exceeding the guarantee issue, or the cancellation of coverage is effective October 1, and will first affect the check dated September 25.

Guarantee Issue: If you're already enrolled, you may increase your existing benefit amount by two increments each year, equal to $20,000, up to a maximum of $200,000 total benefit, for employee coverage without answering the Evidence of Insurability Questionnaire.

An increase in coverage amounts above the guarantee issue is effective upon acceptance by The Standard.

Voluntary Accidental Death & Dismemberment Insurance

(applies to active classified employees only)

The College paid benefit includes $100,000 of basic accidental death and dismemberment coverage for the employee.

Open enrollment is your opportunity to enroll, make changes, or cancel you voluntary accidental death & dismemberment coverage.

- Voluntary Accidental Death & Dismemberment Insurance Rates (see "optional" rate information)

Changes to coverage are effective October 1, and will first affect the payroll check dated September 25.

Long Term Care Insurance

(applies to active classified employees only)

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary long term care insurance coverage.

A reduction or cancellation of coverage is effective October 1, and will first affect the payroll check dated September 25.

All new enrollments and increases in coverage are subject to Evidence of Insurability and become effective upon acceptance by Unum.

Medical, Dental and Vision Benefits

The insurance plan year is October 1 - September 30. With the start of the new insurance year, accumulators (such as deductible, out-of-pocket maximum, alternative care benefits, etc.) start over, or reset to zero, on October 1.

Moda Exception: Any portion of the deductible met in the last 3 months of the plan year (July 1 - September 30) will carry forward to the new plan year.

Faculty who have other group medical insurance and choose to opt-out of the College's medical, dental, and vision benefits, are eligible to receive a monthly stipend of $225.09 ($112.55 per paycheck). Coverage from the Individual Marketplace, Oregon Health Plan/Medicaid or Student Health Insurance does not qualify for opt-out benefits.

- Rate Charts

- Contracted Faculty

- Retiree and Retiree Dependents (total premium amounts only; does not include individual College contribution)

- Plan Comparison

- Medical Plans

- Choose from the following:

Moda Plan 1

Moda Plan 2

Moda Plan 3

Moda Plan 4

Moda Plan 5

Kaiser Plan 1

- Choose from the following:

- Dental Plans

- Choose from the following:

Delta Dental Premier (Moda) Plan 1

Delta Dental Premier (Moda) Plan 5

Delta Dental Premier (Moda) Plan 6

Willamette Dental

- Choose from the following:

- Vision Plan

- The following vision plan is available:

Moda Opal

- The following vision plan is available:

- Medical Plans

Voluntary Life Insurance

(applies to active faculty only)

The College paid benefit includes $100,000 of basic life insurance coverage for the employee.

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary life insurance coverage.

- Voluntary Life Insurance Rates (see "optional" rate information)

- Voluntary Life Insurance Premium Calculator

A reduction in coverage, an increase in coverage not exceeding the guarantee issue, or the cancellation of coverage is effective October 1, and will first affect the payroll check dated September 25.

Guarantee Issue: If you're already enrolled, you may increase your existing benefit amount by two increments each year, equal to $20,000, up to a maximum of $200,000 total benefit, for employee coverage without answering the Evidence of Insurability Questionnaire.

An increase in coverage amounts above the guarantee issue is effective upon acceptance by The Standard.

Voluntary Accidental Death & Dismemberment Insurance

(applies to active faculty only)

The College paid benefit includes $50,000 of basic accidental death and dismemberment coverage for the employee.

Open enrollment is your opportunity to enroll, make changes, or cancel you voluntary accidental death & dismemberment coverage.

- Voluntary Accidental Death & Dismemberment Insurance Rates (see "optional" rate information)

Changes to coverage are effective October 1, and will first affect the payroll check dated September 25.

Long Term Care Insurance

(applies to active faculty only)

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary long term care insurance coverage.

A reduction or cancellation of coverage is effective October 1, and will first affect the payroll check dated September 25.

All new enrollments and increases in coverage are subject to Evidence of Insurability and become effective upon acceptance by Unum.

Medical, Dental and Vision Benefits

The insurance plan year is October 1 - September 30. With the start of the new insurance year, accumulators (such as deductible, out-of-pocket maximum, alternative care benefits, etc.) start over, or reset to zero, on October 1.

Moda Exception: Any portion of the deductible met in the last 3 months of the plan year (July 1 - September 30) will carry forward to the new plan year.

Part-time faculty who have other group medical insurance and choose to opt-out of the College's medical, dental, and vision benefits, are eligible to receive a monthly stipend of $225.09 ($112.55 per paycheck). Coverage from the Individual Marketplace, Oregon Health Plan/Medicaid or Student Health Insurance does not qualify for opt-out benefits.

- Rate Charts

- Part-time Faculty

- Senate Bill 551 (applies only to those not eligible for insurance under the collective bargaining unit agreement)

- Plan Comparison

- Medical Plans

- Choose from the following:

Moda Plan 1

Moda Plan 2

Moda Plan 3

Moda Plan 4

Moda Plan 5

Kaiser Plan 1

- Choose from the following:

- Dental Plans

- Choose from the following:

Delta Dental Premier (Moda) Plan 1

Delta Dental Premier (Moda) Plan 5

Delta Dental Premier (Moda) Plan 6

Willamette Dental

- Choose from the following:

- Vision Plan

- The following vision plan is available:

Moda Opal

- The following vision plan is available:

- Medical Plans

Voluntary Life Insurance

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary life insurance coverage.

- Voluntary Life Insurance Rates (see "optional" rate information)

- Voluntary Life Insurance Premium Calculator

A reduction in coverage, an increase in coverage not exceeding the guarantee issue, or the cancellation of coverage is effective October 1, and will first affect the payroll check dated September 25.

Guarantee Issue: If you're already enrolled, you may increase your existing benefit amount by two increments each year, equal to $20,000, up to a maximum of $200,000 total benefit, for employee coverage without answering the Evidence of Insurability Questionnaire.

An increase in coverage amounts above the guarantee issue is effective upon acceptance by The Standard.

Voluntary Accidental Death & Dismemberment Insurance

Open enrollment is your opportunity to enroll, make changes, or cancel you voluntary accidental death & dismemberment coverage.

- Voluntary Accidental Death & Dismemberment Insurance Rates (see "optional" rate information)

Changes to coverage are effective October 1, and will first affect the payroll check dated September 25.

Long Term Care Insurance

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary long term care insurance coverage.

A reduction or cancellation of coverage is effective October 1, and will first affect the payroll check dated September 25.

All new enrollments and increases in coverage are subject to Evidence of Insurability and become effective upon acceptance by Unum.

Medical, Dental and Vision Benefits

The insurance plan year is October 1 - September 30. With the start of the new insurance year, accumulators (such as deductible, out-of-pocket maximum, alternative care benefits, etc.) start over, or reset to zero, on October 1.

Moda Exception: Any portion of the deductible met in the last 3 months of the plan year (July 1 - September 30) will carry forward to the new plan year.

Managers and management confidential employees who have other group medical insurance and choose to opt-out of the College's medical, dental, and vision benefits, are eligible to receive a monthly stipend of $200.00 ($100.00 per paycheck). Coverage from the Individual Marketplace, Oregon Health Plan/Medicaid or Student Health Insurance does not qualify for opt-out benefits.

- Rate Charts

- Active Employees

- Retiree and Retiree Dependents (total premium amounts only; does not include individual College contribution)

- Plan Comparison (for active employees)

- Medical Plans

- Choose from the following:

Kaiser Plan 1

Moda Plan 1

Moda Plan 2

Moda Plan 6* (*Enrollment in a Health Savings Account ("HSA") is optional and available with Plan 6.)

- Choose from the following:

- Dental Plans

- Choose from the following:

Delta Dental Premier (Moda) Plan 1

Delta Dental Premier (Moda) Plan 6

Willamette Dental

- Choose from the following:

- Vision Plans

- Choose from the following:

Moda Opal

VSP Choice Plus

- Choose from the following:

- Medical Plans

- Plan Comparison (for retired employees)

- Medical Plans

- Choose from the following:

Kaiser Plan 1

Moda Plan 1

Moda Plan 2

Moda Plan 6

Moda Plan 7

- Choose from the following:

- Dental Plans

- Choose from the following:

Delta Dental Premier (Moda) Plan 1

Delta Dental Premier (Moda) Plan 6

Willamette Dental

- Choose from the following:

- Vision Plans

- Choose from the following:

Moda Opal

VSP Choice Plus

- Choose from the following:

- Medical Plans

Voluntary Life Insurance

(applies to active management employees only)

The College paid benefit includes $100,000 of basic life insurance coverage for the employee.

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary life coverage.

- Voluntary Life Insurance Rates (see "optional" rate information)

- Voluntary Life Insurance Premium Calculator

A reduction in coverage, an increase in coverage not exceeding the guarantee issue, or the cancellation of coverage is effective October 1, and will first affect the check dated September 25.

Guarantee Issue: If you're already enrolled, you may increase your existing benefit amount by two increments each year, equal to $20,000, up to a maximum of $200,000 total benefit, for employee coverage without answering the Evidence of Insurability Questionnaire.

An increase in coverage amounts above the guarantee issue is effective upon acceptance by The Standard.

Voluntary Accidental Death & Dismemberment Insurance

(applies to active management employees only)

The College paid benefit includes $100,000 of basic accidental death and dismemberment coverage for the employee.

Open enrollment is your opportunity to enroll, make changes, or cancel you voluntary accidental death & dismemberment coverage.

- Voluntary Accidental Death & Dismemberment Insurance Rates (see "optional" rate information)

Changes to coverage are effective October 1, and will first affect the payroll check dated September 25.

Long Term Care Insurance

(applies to active management employees only)

Open enrollment is your opportunity to enroll, make changes, or cancel your voluntary long term care insurance coverage.

A reduction or cancellation of coverage is effective October 1, and will first affect the payroll check dated September 25.

All new enrollments and increases in coverage are subject to Evidence of Insurability and become effective upon acceptance by Unum.

Human Resources Contact Information

Benefits Team:

Kali Phillips (last names beginning A-L, except part-time faculty)

Phone: 541-463-5589

Email: phillipsk@lanecc.edu

Emily Madden (last names beginning M-Z and all part-time faculty)

Phone: 541-463-3193

Email: maddene@lanecc.edu

Main Office:

Human Resources

4000 E 30th Ave (main campus)

Bldg 3 Room 114

Phone: (541) 463-5586

Email: humanresources@lanecc.edu

Appointments are strongly encouraged due to hybrid work locations and availability.