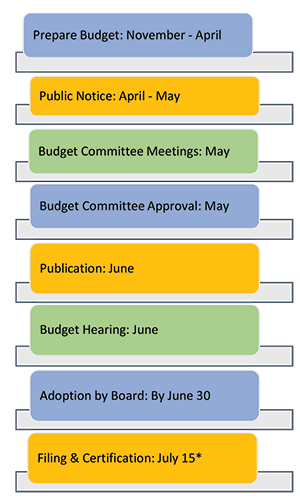

Lane follows Oregon Local Budget Law, as outlined in the budget development process below. In addition to providing a financial plan for fiscal year revenues and expenses, Lane's Budget Document outlines programs and initiatives and implements controls on spending authority. The budget development process is designed to encourage citizen input and public opinion about the college's programs and fiscal policies.

For information on the development of the current year budget, see:

2026/27 Budget Development

Axiom Login Page

Prior Years Budget Development

- 2025/26 Budget Development

- 2024/25 Budget Development

- 2023/24 Budget Development

- 2022/23 Budget Development

- 2021/22 Budget Development

- 2020/21 Budget Development

- 2019/20 Budget Development

- 2018/19 Budget Development

- 2017/18 Budget Development

- 2016/17 Budget Development

- 2015/16 Budget Development

- 2014/15 Budget Development

Budget Development Process

Establish a Budget Committee

The Budget Committee consists of the seven members of the Board of Education plus seven citizens at large. Each Board member appoints one citizen to the committee for a term of three years. Terms are staggered so that about one-third of the appointed terms end each year.

Appoint a Budget Officer

Lane's Budget Officer is appointed by the Board of Education.

Prepare a Proposed Budget

The Budget Officer supervises the preparation of a proposed budget, which includes the following actions:

- Discuss Budget Assumptions with Budget Committee

- Develop Resource (Revenue) Estimates:

- Develop Base Expenditures Budget

- Estimate Preliminary Surplus/Deficit

- Develop Changes to Base and Final Budgets

- Align with Strategic Directions

- Analyze Department Needs and Requests

- Determine Tuition Rate

- Develop Reduction, Reallocation and Addition Recommendations

- Prepare Budget Message for the Budget Committee, public, employees and other stakeholders.

Public Notice

Lane's Budget Officer publishes a public Notice of Budget Committee Meeting(s).

Budget Committee Meeting(s)

At least one Budget Committee meeting is held to

- review the budget message and document,

- hear the public and

- revise and complete the budget as needed.

At the time the proposed budget is distributed to the Budget Committee, it becomes public record and is made available to the public.

Budget Approval

When the Budget Committee is satisfied with the proposed budget, including any additions to or deletions from the one prepared by the Budget Officer, the budget is approved.

Note: If the budget requires an ad valorem tax to be in balance, the budget committee must approve an amount or rate of total ad valorem property taxes to be certified to the assessor.

Publication

After the budget is approved, a budget hearing is held by the Board of Education. The Budget Officer publishes a summary of the approved budget and a Notice of Budget Hearing.

Budget Hearing

The Budget Hearing is held to receive citizens' testimony on the approved budget.

Adoption

The Board of Education enacts a resolution to

- formally adopt the budget,

- make appropriations, and, if needed,

- levy and categorize taxes.

The resolution must be adopted no later than June 30.

Budget Filed and Levy Certified

A copy of the complete budget is sent to the Lane County Clerk. When levying a property tax, Lane's Budget Officer submits notice of levy, categorization certification and resolutions to the County Assessor's office by July 15.