How to use the IRS Data Retrieval Tool or Request a Tax Transcript or Get a Verification of Non-filing Letter from the IRS

IRS Data Retrieval Tool Tutorial:

Tax Transcripts

When you complete the FAFSA, the IRS Direct Data Exchange (FA-DDX) allows your federal tax information (FTI) to be securely transferred from the IRS directly into your FAFSA. This helps ensure accuracy, reduces the need for manual income entry, and speeds up financial aid processing.

While FA-DDX simplifies the process for most students, some situations may still require additional documentation, such as IRS Tax Return Transcripts or Wage and Income Transcripts, to complete the verification process or resolve discrepancies.

Important: Be sure to keep a copy of your transcript for your records and write the student ID number (L number) on your transcript before submitting it to Lane CC.

Online: Immediately access and print your transcript online.

- Go to www.irs.gov.

- Hover over the word "File" in the top left hand corner. Then click "Get Your Tax Record".

- Select "Get Transcript ONLINE" or "Get Transcript by Mail". The online method is faster as it allows users instant access.

- Get Transcript ONLINE - create an account with the IRS and follow the steps to receive instant access to a .PDF of your Tax Return Transcript. Be sure to choose "Return Transcript" and enter the appropriate tax year ("2023" for the 2025-2026 FAFSA).

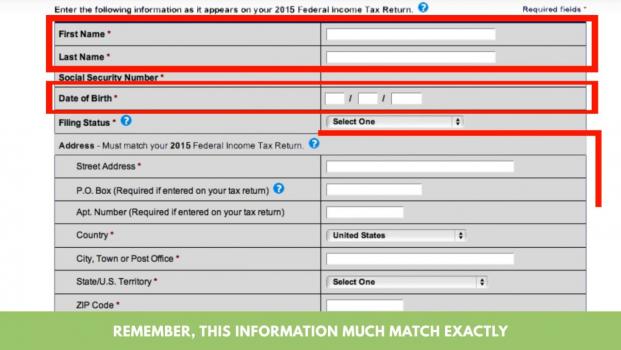

- Get Transcript by Mail - Enter in the SSN or ITIN and date of birth of the tax filer. As well as the street address and ZIP or postal code. The address must match the mailing address from your latest tax return. Be sure to choose "Return Transcript" and enter the appropriate tax year ("2023" for the 2025-2026 FAFSA). Transcripts arrive in 5 to 10 calendar days at the address the IRS has on file.

Verification of Non-filing Letter

An IRS Verification of Non-filing Letter provides proof the IRS has no record of a filed Form 1040 for the year you are requesting. Non-tax filers can request a free IRS Verification of Non-filing Letter using one of the options below.

Important: Be sure to keep a copy of your IRS Verification of Non-filing Letter for your records and write the student ID number (L number) on your letter before submitting it to Lane CC.

Note: This is typically not available if you have never filed taxes before in prior years. If at any point you cannot validate your identity, use the paper request below.

Online: Immediately access and print your transcript online. If at any point you cannot validate your identity, use the paper request option below.

- Go to www.irs.gov.

- Hover over the word "File" in the top left hand corner. Then click "Get Your Tax Record".

- Click "Get Transcript ONLINE"

- Enter the requested information and click "Continue".

- Select "Verification of Non-filing Letter" and in the Tax Year field, select the appropriate tax year ("2023" for the 2025-2026 FAFSA).

- If successfully validated, you will be able to view and print the Verification of Non-filing letter.

Mail: If the person requesting the Verification of Non-filing Letter has filed taxes before, they may be able to request a "Tax Return Transcript" by mail.

- Go to www.irs.gov.

- Hover over the word "File" in the top left hand corner. Then click "Get Your Tax Record".

- Click "Get Transcript by Mail"

- Enter in the SSN or ITIN and date of birth of the tax filer. As well as the street address and ZIP or postal code. The address must match the mailing address from your latest tax return.

- Select "Tax Return Transcript" and in the Tax Year field, select the appropriate tax year ("2023" for the 2025-2026 FAFSA).

- If successfully validated, transcripts arrive in 5 to 10 calendar days at the address the IRS has on file.

Mail: If the person requesting the Verification of Non-filing letter has never filed taxes before, they will need to use IRS Form 4506-T to request their Verification of Non-filing Letter.

- Go to the Form 4506-T page of the IRS Website.

- Complete line 1-4, following the instructions on page 2 of the form.

- In line 7, select the checkbox on the right hand side for Verification of Nonfiling.

- In line 9, in the year or period requested field, enter 12/31/2023 for the 2023 tax year.

- Make sure to sign and date the form.

- Mail to the address listed or fax to the fax number on page 2. Most requests will be processed within 10 business days.

W-2 Information

If you are unable to locate your W-2 forms, the quickest way to obtain a copy is to contact the employer and request a duplicate. If you are unable to obtain a duplicate W-2 from your employer(s), you may request a Wage and Income Transcript from the IRS using one of the following methods:

Online: Immediately access and print your Wage and Income Transcript online. If at any point you cannot validate your identity, use the paper request option below.

- Go to IRS Website.

- Hover over the word "File" in the top left hand corner. Then click "Get Your Tax Record".

- Select "Get Transcript ONLINE"

- Get Transcript ONLINE - create a free account with the IRS and follow the steps to receive instant access to a .PDF of your Wage and Income Transcript. Be sure to choose "Wage and Income Transcript" and enter the appropriate tax year ("2023" for the 2025-2026 FAFSA).

Mail: If you are not able to request a copy of your W-2's from your former employer and you are not able to use the Get Transcript Online method to request a copy of your wage and income transcript. Then follow the steps below for requesting a copy of your wage and income transcript through a third method called Form 4506-T.

- Go to the Form 4506-T page of the IRS Website.

- Complete line 1-4, following the instructions on page 2 of the form.

- In line 8, select the checkbox on the right hand side for Form W-2, Form 1099 series, Form 1098 series, or Form 5498 series transcript.

- In line 9, in the year or period requested field, enter 12/31/2023 for the 2023 tax year.

- Make sure to sign and date the form.

- Mail to the address listed or fax to the fax number on page 2. Most requests will be processed within 10 business days.

Helpful Hints:

- Have your taxes in front of you and enter the address as it appears on your return.

- The address on file is typically the address on your most recent return.

- Spelling out the word "street" rather than using the abbreviation "st" can be enough to cause an error.

- Go to the IRS Transcript website which address specific questions about getting transcripts online.

- Filers of amended returns must provide either a tax return transcript or a signed copy of the tax return with all applicable schedules AND a signed copy of the 1040X that was filed with the IRS.

Contact Financial Aid

Title IV Federal School Code: 003196

If you need to submit documentation, please use our secure digital dropbox. You will be asked to log in with your L Number and myLane password.

Financial Aid Office Bldg 1

4000 East 30th Ave.

Eugene, Oregon 97405

Thursday: 10:00 a.m. – 5:00 p.m.

Friday: 8:30 a.m.- 2:00 p.m.