For more than half a century, Lane Community College has opened doors to opportunity for Lane County to prepare people for university transfer, skilled careers, personal enrichment, and meaningful work. Our mission remains constant: excellent, accessible education that changes lives and lifts communities.

Lane has chosen a path of prosperity, relevance, and growth. Looking ahead, our strategic vision is clear: Lane is the workforce and talent development hub of Lane County and beyond. We will remain responsive to community needs, providing excellent university transfer pathways and stellar career programs. Local employers will continue to rely on Lane graduates, and the community will find opportunities to build career skills, engage with the arts and sciences, and benefit from thriving health sciences and trades programs. Lane’s differentiator will continue to be workforce readiness and experiential learning. Internally, we will be even more focused and nimble, investing in what matters most: programs with strong student outcomes, high-impact services, and infrastructure that supports learning and innovation.

To secure that future, the Board of Education approved a Fiscal Year 2026 budget that includes reductions to close a projected multi-year shortfall. Acting now prevents depletion of reserves and avoids crisis-driven cuts later, as a nearly $10 million structural imbalance looms over the next four years. These are planned, deliberate decisions designed to protect the student experience and sustain our core mission—not a retreat from our values. Budget reductions are part of a longer-term transformation that positions Lane to thrive.

Our approach to aligning resources is transparent and principled. Decisions are guided by four commitments:

- Protect Student Success: Limit impacts on high-impact programs and services whenever possible.

- Align with Strategic Priorities: Support fiscal health, enrollment growth, and a positive climate.

- Use Data and Evidence: Apply the Board’s values of fiscal stability, student success, employee well-being, and community responsiveness.

- Ensure Equity: Consider potential disproportionate effects on underserved students and employees.

Future budget planning will continue to include campus forums, listening sessions, written feedback from departments and individuals, regular briefings with the College Council, and data analyses to minimize harm to our mission. The Board sets fiscal direction and approves the overall framework; the President implements it with care and urgency, consistent with our mission and governance model.

Change is never easy, and we recognize the people and programs behind every number. By facing challenges directly and staying student-centered, Lane will emerge stronger, more focused, and ready to serve this community for the next sixty years.

Related Links:

Budget Questions & Answers - Explanatory Summary

Our projected deficit reflects rising costs that outpace the college’s revenue growth. The largest drivers are salaries and benefits. For non-personnel costs (i.e., materials and supplies, contracts, equipment, etc.), the inflation rate for higher education is projected to be above 3% in FY26 and FY27. The current forecast is set to just 2% as an effort to balance personnel costs. Even small percentage changes add up quickly across hundreds of employees.

These projections aren’t inflated; they are meant to help us prepare early and avoid sudden, deeper cuts later. The Budget Development Subcommittee, a subcommittee of the College Council, is beginning its work to understand and refine these assumptions. In its first meeting on October 15th, the committee members agreed that more than the two currently scheduled meetings for fall would not be enough time to thoroughly think through the rapidly changing financial landscape in front of us. The co-chairs are adding more frequent meetings to the fall calendar.

No, the College raised the Other Payroll Expenses (OPE) rate by one percentage point this year to plan for a 500,000 increase in the debt payment for our Pension Bonds in FY27. In addition, the employer PERs contribution rate is set to increase as our 2003 PERs bond investment sunsets.". The way it is currently stated is not 100% accurate as our bond payment will not increase in 2028. However, our employer contribution rate will increase due to the ending of the 2003 bond.

From FY23 to FY25, our total benefit costs rose by $4.5 million, and we expect another $5 million increase over the next three years. Even though the OPE rate might appear higher than actual costs in a given year, any difference rolls back into the Ending Fund Balance. This amount has varied throughout the history of the College.

PERS Bond Debt Schedule - Budget Document: Fund III

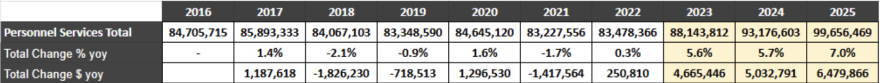

While total personnel costs have grown only 17% over the last decade, most of that growth occurred in recent years. Between FY24 and FY25 alone, total personnel costs rose more than 7%.

Faculty and Classified employees receive both step and COLA increases (typically around 4% + 3%), and management salaries increased 4% this year after many years of minimal increases. The result is that even though individual raises are reasonable, the total cost of salaries and benefits grows faster than our ongoing revenue sources. Enrollment, which is less than a third of our total revenue, is still below pre-pandemic levels. Yet our total personnel costs are the highest they've been in over ten years.

See also:

- “Salary Schedule” under each employee group

- HR Dashboard (note: this is updated every board meeting; check BoardDocs for the most recent meeting)

The above table references all funds, and includes other personnel expenses (OPE)

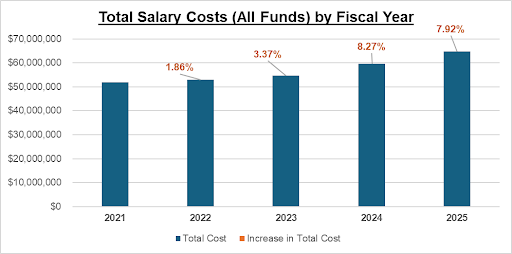

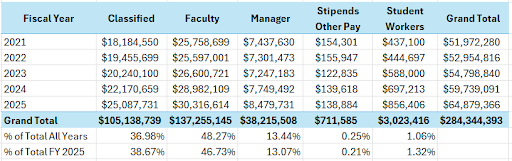

No. Across all employee groups—faculty, classified, and management—step increases are no longer offset by turnover or lower-cost hiring. According to Lane Community College’s HR Dashboards (Sept & Oct 2025), total personnel costs have risen about 10 % from FY 2023 to FY 2025, while total FTE has declined 0.8 %, meaning higher average costs per employee rather than workforce growth.

For faculty, salary costs increased ≈ 9–10 % even as FTE declined 3 %. For classified staff, costs rose ≈ 9 % with flat FTE. For management, costs climbed ≈ 11–12 % with only 1–2 % FTE growth. These trends stem from contractual COLA and step increases, equity and reclassification adjustments, reduced turnover savings, and rising benefit (OPE) costs.

These patterns mirror statewide findings from the Oregon HECC, PERS, and the State DAS Workforce Report, which all show 4–6 % annual wage and benefit growth across Oregon’s public higher-education sector.

Bottom line: step increases are no longer financially neutral. Even with stable or declining staffing levels, overall personnel costs continue to rise due to sustained wage, classification, and benefit pressures.

It’s true that our EFB improved modestly in FY23 and FY24, thanks to enrollment recovery, state funding, and everyone’s hard work. However, we are still below the Board’s 10% reserve policy target (BP6230 - https://go.boarddocs.com/or/lanecc/Board.nsf/Public#). Additionally, the projected FY25 ending fund balance is decreasing. The audited financial statements will be completed by December 31st, 2025.

We also had to make mid-year budget reductions each year to maintain that balance—for instance, pulling back $1 million mid-year last year. See the February 5, 2025 Board Meeting finance presentation. One-time COVID relief funds that helped stabilize the budget were depleted in FY23, and our ongoing revenues (tuition, state support, property taxes) can fluctuate. From FY 2020 to FY 2023, the college deposited COVID funds of approximately $18M into the general fund.

Furthermore, in October 2025, the state warned colleges of a potential mid-biennium cut to state funding, which would mean about $5.8 million, or 7-8% less for Lane this budget cycle. That’s nearly one month of payroll. Maintaining a healthy ending fund balance is what allows us to absorb these unexpected changes without emergency layoffs or disruption to students.

Some revenue sources, like tuition and property tax, have increased slightly, but not nearly at the rate of expenses. Enrollment is still below pre-pandemic levels, and state funding—our largest source of revenue—is projected to decline. Inflation also means the same dollar buys less each year. Even small shortfalls compound when applied to a $104 million general fund. Tuition and fee revenue has increased as a result of steady tuition rate increases, not just enrollment growth. This translates to a higher cost for students in a time when their cost of living at home is steadily increasing. Furthermore, Lane is the second most expensive community college in Oregon.

Enrollment - see page 17 of the FY25 budget document

Some classes—especially those with fewer than 10–12 students—don’t bring in enough tuition to cover the cost of instruction, including instructor cost, supplies, instruction support, and overhead. When a section runs far below capacity (particularly when there is capacity in other sections of the same course or suitable alternatives for students), the college loses money even if tuition is collected.

Modeling financial implications is a starting point, not a sole deciding factor. Recognition is given that certain courses must continue for academic or student-success reasons—such as maintaining cohort programs or ensuring students can progress toward completion. Our goal is to provide financial data that can be taken into consideration as another factor in making decisions while supporting student needs and program integrity.

No. Oregon Budget Law (ORS 294) requires a public process for adopting each annual budget, including Budget Committee review and a public hearing. Discussing long-term goals and targets—like reducing structural deficits over several years—is not the same as adopting future budgets or committing to cuts. The Finance Office has consulted with officials in the Oregon Department of Revenue, who oversee Oregon Budget Law. They have confirmed that no violations have occurred.

No formal action that would authorize cuts or spending allocations have taken place at this time. What’s being shared now are financial projections and planning discussions to help the Board, Budget Committee, and campus community understand the scale of the challenge ahead.

When it comes time to adopt next fiscal year’s budget, that will always still occur through the full public process—review, hearings, and Board approval—consistent with state law and the College’s budget calendar as has been historically and will continue to always be practiced. Transparency and early dialogue are essential to ensure decisions are well-informed and legally compliant.

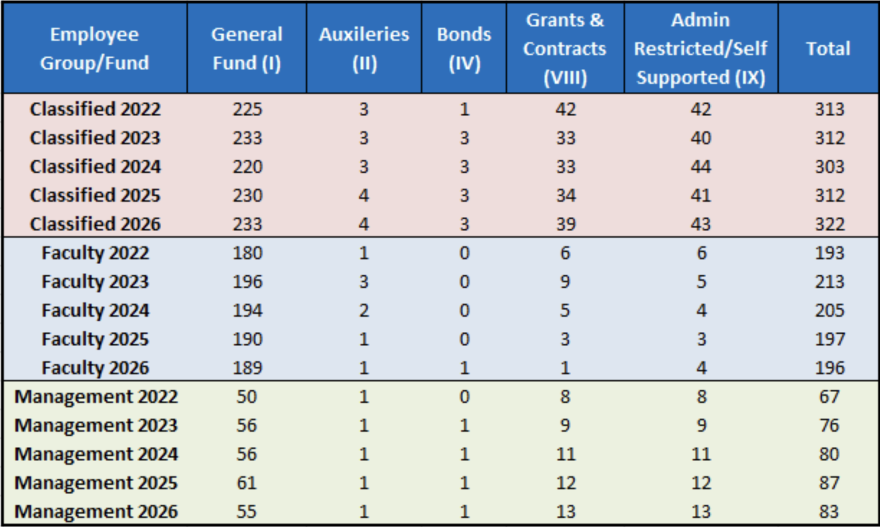

No. The number of management positions funded by the general fund has remained stable.

Any increases in total manager headcount are tied to grant-funded or self-supporting programs—such as Lane Child and Family Center, KLCC, or International Programs—that are not supported by general fund dollars. In previous years, those auxiliary and grant-funded positions were underreported, creating the appearance of growth when in reality they were simply not included in earlier counts.

Budget Process & Transparency

The budget starts with projections from the Budget Office and reviewed by the Budget Development Subcommittee and College Council. It then moves to the Budget Committee for public discussion and finally to the Board for approval in open meetings.

See the Budget Office website for more detailed information.

A structural deficit means fixed expenses (ex. Personnel costs, contracts, utilities, etc ) are higher than ongoing revenues. Budget cuts are one-time actions taken to close that gap. The goal is to fix the structure, not just reduce costs temporarily.

Committees like the Budget Development Subcommittee, College Council, and Budget Committee all review data, provide input, and make recommendations to leadership and the Board before adoption. This input is to help develop the financial framework for the College and direction for the policies that guide the College, not to make decisions on day-to-day operations.

All meetings are public, materials are posted online, and the process follows Oregon Budget Law. Anyone can attend, provide public comment, or review documents on the College’s website. The College also has many opportunities to give input and attend learning and listening sessions regarding the finances and strategic vision.

Reserves, Risk, and Long-Term Stability

A 10% Ending Fund Balance equals about one and a half months of payroll. It provides a cushion for emergencies, enrollment declines, or state funding cuts.

The College must create a three-year plan to restore it. Dropping below the target can hurt financial stability and lower the College’s Moody’s rating - making it harder for us to take out loans or bonds. BP 6230, Ending Fund Balance.

We’re improving forecasting, centralizing shared services, recovering indirect costs from grants, and linking budget decisions to enrollment and program outcomes. We are also constantly wrapping in the strategic mission, board values, and presidential goals. Continuous engagement across the College and data informed decision making will always be the top priority.

Revenue & Enrollment

Enrollment drives both tuition and state funding. A 1% enrollment change, specifically the number of credits a student takes each year, can mean the difference of about $240,000 dollars in revenue.

Oregon’s Community College Support Fund is distributed based on student FTE across all 17 colleges. When statewide enrollment shifts, each college’s share changes, sometimes mid-biennium. State funding is calculated using a three year weighted average of fundable student FTE, where the most recent year’s enrollment counts for slightly more than the prior two years. There is also typically a cap on enrollment change. Last year's biennium had a 2.5% cap on growth that was eligible for reimbursement. Any growth over 2.5% incurs the same cost to the College with no additional support from the State.

Tuition is reviewed annually with student input. The Board considers enrollment trends, inflation, and affordability before setting rates each winter term. This is set before the budget framework is finalized, ensuring that student affordability is a priority over balancing the budget.

Personnel & Labor Costs

Step and cost-of-living increases are negotiated and binding. Because salaries and benefits make up over 80% of the general fund, small increases add up quickly. See on the payroll website, “salary schedules”, under each employee group.

Not currently. Any changes would be driven by enrollment and program needs, reviewed through governance processes, and communicated openly.

Grants, Auxiliaries, and One-Time Funds

Most grants are restricted to specific purposes, like workforce training or student support. They can’t be used to cover general operating costs.

The general fund pays for core operations. Grants are restricted external funds. Auxiliaries—like childcare or KLCC—are self-supporting and must earn their own revenue.

They stabilized budgets during FY21–FY23 but have ended. The College now relies fully on recurring revenues from tuition, property tax, and state support.

Future Outlook

We’re expanding financial modeling tools, enhancing reporting, and strengthening collaboration between Finance, HR, IR, and Academic Affairs. Further, we are making every effort to engage with all stakeholders at the College, including students, faculty, and classified staff.

The goal is stability—protecting programs, jobs, and access for students while ensuring the College remains financially healthy long term.